We have previously discussed the numerous ways to record Shopify sales, showcased here. What these blogs have not gone into much detail about was the recording of your Cost of Goods. This can be complicated or easy depending on your products and your accounting for inventory. The following post will show you a quick way to calculate the cost of goods sold for a set period.

Under accrual-based accounting (the concept of matching revenue to its associated expenses), for us to record sales, we need to record our cost of goods. Shopify, a leading platform for e-commerce companies, is a great product. You can set up an online store with an enticing theme in a matter of minutes however, Shopify’s financial center lacks the robustness for helping you track your cost of goods.

What Exactly Is Cost of Goods Sold?

Any accounting book will tell you that these are the expenses directly related to the sale that occurred. For example, if you sell t-shirts online you’ll have multiple ‘costs’- the cost of the shirt, the import fee you pay, the shipping to get your product to your facility. Now if you manufacture your own goods, it gets even more complicated, above the scope of this post. But the core concept of the cost of goods sold is the cost to acquire the product you have sold.

Now that we have set a baseline lets understand why Shopify fails to address this:

Shopify’s Shortcomings

Shopify helps you track your sales, refunds, discounts, and exchanges. If you set up your inventory properly, it will track inventory and tell you how many units you have. What information did you not enter into your store? Your cost of goods

Shopify Tracks Net Sales

Shopify records the total unit number of items that were shipped out each month. Items shipped – items returned = net sales. For most basic stores, this is the only information you need from Shopify to quickly record or calculate the cost of goods sold.

Cost of Goods Sold

Assuming we are not tracking inventory or even looking at it for that matter, but we just want to know your cost of goods for the month. We can simply take the “Sales by Product” report located under “Sales” – “Analytics.” Here we select the time period we would like the report (usually monthly is easiest – unless you report financials on a weekly basis). The fourth column over will tell you your net sales for the period by item.

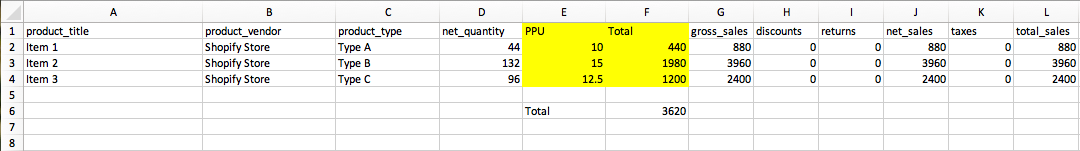

You should take that report and export it to excel so you can manipulate it. If you only have a few items and prefer not to manipulate, save a PDF, so you have a backup in the future if you ever need to look back. Once you have the report in excel, simply add two columns, one for your landed price, PPU, (or the price your vendor sells you the good) and the other would be your total cost. To get the total cost, multiply the net quantity by the PPU, then sum the total column for all relevant items.

Above under column “Total,” we now have the total cost per item and for the entire period for all items.

Know Your Costs

The one key aspect of the above calculation is you knowing your price per unit (or PPU) also known as your cost per unit. If you do not know this number than performing the above analysis is worthless. Finding the cost per unit number can be a bit challenging for first time Shopify sellers.

So we’ll go ahead and walk you through this:

Take your most recent invoice, some will have multiple items on there, some will not. For the sake of practice, simply take one item to find the total you paid for all units and divide that by how many units you got. If your vendor is nice, you will have this number already outline on the invoice (still do the math to make sure they match though). Now to take this a step further, let’s say you have once an item that has two different parts that you are combining to make 1 finished final good. An example of this would be the Product A you buy from 1 vendor and the packaging (Product B) you buy from another vendor. So essentially we just need to expand our original calculation.

We take both invoices, find the cost per unit for each. Then we combine the per unit item for each product and get the total cost we have.

Now for those of you that have import freight or another Cost of Goods sold expense you want to include. You simply need to find the per-unit average cost of this additional expense and add that to your cost of goods sold calculation:

Cost of Product A

+ Cost of Product B

+ Import Freight Cost of Product A

+ Import Freight Cost of Product B

———————————————-

= Cost Per Unit

At the end of the day it all is basic arithmetic, though there are variables that change depending on the nature of your business.

Wrapping up Shopify Cost of Goods Sold

Shopify has some great reporting features and some not so great reporting features. They give you enough of the basic tools you need to calculate your Cost of Goods Sold. Simply export your net sales and use your quick and dirty calculation to get your per-unit cost of goods sold. Then simply multiply the two together for all products you have and you can get your total Cost of Goods sold for the month.

Learn About Flowify

Having trouble integrating all your sales, refunds, fees, bank deposits (& more) seamlessly from Shopify into QuickBooks? Flowify is a sleek Shopify accounting app that I recommend. It is the secret sauce that helps propel Shopify stores to next-level success. Learn more by clicking here.

Great article mate, what’s the best app to push cogs to xero and what’s the best goods received process?

Not sure, have not used any apps for the Xero + Shopify integration yet.