If your Software as a Service (SaaS) business is anything like the ones I have been a part of, they are a fast-moving and exciting business to be involved in. Unfortunately, this leaves many owners or operators thinking about their financial setup, like their Chart of Accounts last. Like that P1 bug your team resolved early this morning, a proper Chart of Accounts for your SaaS business will not only set you up for long term success but should be another item you put behind you as well.

I often get asked is my chart of accounts correct? What should I do to make my accounting better? Should I update my chart of accounts? Often there are other major issues that need to be addressed when the chart of accounts comes up in conversation – such as underreporting revenue, not properly reporting financials, or not following GAAP. SaaS businesses often overreport revenue as they do not properly defer revenue until the period it is actually earned. Luckily a great Chart of Accounts gives you the base to resolve any curveballs that may come your way as you scale your SaaS business. Think about it like the foundation of your dream home, without the proper slab to build on, everything build will likely collapse on itself.

A proper chart of accounts gets your business started on the right foot. By condensing items in particular categories you get an income statement that is both legible and concise. By grouping similar items like current liabilities or long term liabilities, your reporting can quickly be condensed to drive your financial review to the bottom line (pun intended).

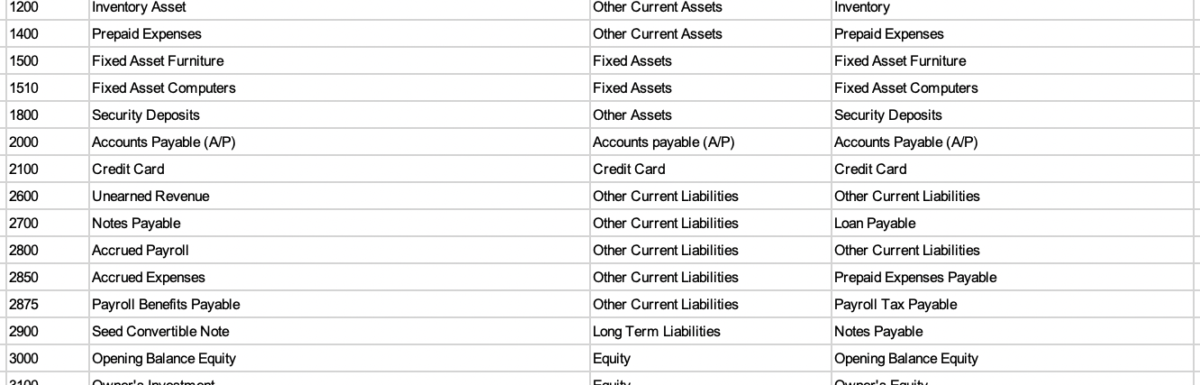

Below is a simple chart of accounts. Please tailor it to fit your unique business and business model.

| Account # | Account | Type | Detail type |

| 1010 | Bank – Checking | Bank | Checking |

| 1020 | Bank – Savings | Bank | Savings |

| 1100 | Accounts Receivable (A/R) | Accounts receivable (A/R) | Accounts Receivable (A/R) |

| 1200 | Inventory Asset | Other Current Assets | Inventory |

| 1400 | Prepaid Expenses | Other Current Assets | Prepaid Expenses |

| 1500 | Fixed Asset Furniture | Fixed Assets | Fixed Asset Furniture |

| 1510 | Fixed Asset Computers | Fixed Assets | Fixed Asset Computers |

| 1800 | Security Deposits | Other Assets | Security Deposits |

| 2000 | Accounts Payable (A/P) | Accounts payable (A/P) | Accounts Payable (A/P) |

| 2100 | Credit Card | Credit Card | Credit Card |

| 2600 | Unearned Revenue | Other Current Liabilities | Other Current Liabilities |

| 2700 | Notes Payable | Other Current Liabilities | Loan Payable |

| 2800 | Accrued Payroll | Other Current Liabilities | Other Current Liabilities |

| 2850 | Accrued Expenses | Other Current Liabilities | Prepaid Expenses Payable |

| 2875 | Payroll Benefits Payable | Other Current Liabilities | Payroll Tax Payable |

| 2900 | Seed Convertible Note | Long Term Liabilities | Notes Payable |

| 3000 | Opening Balance Equity | Equity | Opening Balance Equity |

| 3100 | Owner’s Investment | Equity | Owner’s Equity |

| 3200 | Owner’s Pay & Personal Expenses | Equity | Owner’s Equity |

| 3300 | Retained Earnings | Equity | Retained Earnings |

| 3400 | Common Stock | Equity | Common Stock |

| 4000 | Sales | Income | Sales of Product Income |

| 4100 | Monthly Recurring Revenue | Income | Service/Fee Income |

| 4200 | On-Demand Revenue | Income | Sales of Product Income |

| 4300 | Post Launch Services | Income | Sales of Product Income |

| 4900 | Billable Expense Income | Income | Sales of Product Income |

| 5100 | Merchant Processing Fees | Cost of Goods Sold | Supplies & Materials – COGS |

| 5200 | Sales Commissions | Cost of Goods Sold | Supplies & Materials – COGS |

| 6000 | Payroll Expenses | Expenses | Payroll Expenses |

| 6100 | Payroll Expenses:Taxes | Expenses | Payroll Expenses |

| 6200 | Payroll Expenses:Wages | Expenses | Payroll Expenses |

| 6300 | Employee Benefits | Expenses | Payroll Expenses |

| 6350 | Workers’ Comp | Expenses | Payroll Expenses |

| 6400 | Recruiting | Expenses | Office/General Administrative Expenses |

| 6500 | Payroll Fees | Expenses | Payroll Expenses |

| 6600 | Contractors | Expenses | Payroll Expenses |

| 6700 | Legal & Professional Services | Expenses | Legal & Professional Fees |

| 6710 | Legal & Professional Services:Accounting & Tax Fees | Expenses | Legal & Professional Fees |

| 6720 | Legal & Professional Services:IT Service Fees | Expenses | Legal & Professional Fees |

| 6730 | Legal & Professional Services:Legal Services | Expenses | Legal & Professional Fees |

| 6740 | Legal & Professional Services:Other Professional Fees | Expenses | Legal & Professional Fees |

| 6800 | Product Development | Expenses | Office/General Administrative Expenses |

| 6810 | Product Development:Website Expense | Expenses | Other Miscellaneous Service Cost |

| 6820 | Product Development:Software Development | Expenses | Other Miscellaneous Service Cost |

| 7000 | Facilities | Expenses | Rent or Lease of Buildings |

| 7100 | Facilities:Office Rent | Expenses | Rent or Lease of Buildings |

| 7200 | Facilities:Non-Technology Utilities | Expenses | Utilities |

| 7300 | Facilities:Office Supplies & Expenses | Expenses | Office/General Administrative Expenses |

| 7350 | Facilities:Office Furniture | Expenses | Office/General Administrative Expenses |

| 7400 | Repairs & Maintenance | Expenses | Repair & Maintenance |

| 7600 | Advertising & Marketing | Expenses | Advertising/Promotional |

| 7610 | Advertising & Marketing:PPC Advertising | Expenses | Advertising/Promotional |

| 7620 | Advertising & Marketing:Email Marketing | Expenses | Advertising/Promotional |

| 7630 | Advertising & Marketing:Conferences & Tradeshows | Expenses | Advertising/Promotional |

| 7640 | Advertising & Marketing:Affiliate Marketing | Expenses | Advertising/Promotional |

| 7650 | Advertising & Marketing:Branding | Expenses | Advertising/Promotional |

| 7700 | Travel Expenses | Expenses | Travel |

| 7710 | Travel Expenses:Travel Transportation | Expenses | Travel |

| 7720 | Travel Expenses:Travel Lodging | Expenses | Travel |

| 7730 | Travel Expenses:Travel Meals | Expenses | Travel Meals |

| 7750 | Customer Service | Expenses | Office/General Administrative Expenses |

| 7800 | Sales Expense | Expenses | Other Business Expenses |

| 7810 | Dues & subscriptions | Expenses | Dues & subscriptions |

| 7820 | Bank Charges & Fees | Expenses | Bank Charges |

| 7830 | Credit Card Processing Fees | Expenses | Bank Charges |

| 7840 | Sales and Use Tax | Expenses | Taxes Paid |

| 7850 | Fines and Fees | Expenses | Office/General Administrative Expenses |

| 7860 | Insurance | Expenses | Insurance |

| 7870 | Meals & Entertainment | Expenses | Entertainment Meals |

| 7880 | Company Recreation | Expenses | Promotional Meals |

| 7900 | Ask My Accountant | Expenses | Other Miscellaneous Service Cost |

| 8000 | Interest Paid | Expenses | Interest Paid |

| 8100 | Interest Earned | Other Income | Interest Earned |

| 8150 | Other Miscellaneous Income | Other Income | Other Miscellaneous Income |

| 8200 | Gain on Sale of Asset | Other Income | Other Miscellaneous Income |

| 8300 | Tax Expense | Other Expense | Other Miscellaneous Expense |

| 9100 | Depreciation | Other Expense | Depreciation |

| 9200 | Amortization | Other Expense | Amortization |

After the first review, the SaaS chart of accounts can be quite overwhelming, but don’t fret! Remember that the goal is to keep the income statement on one page so you can quickly review the financial performance of your business.

Another key takeaway is to understand that the above can be manipulated to serve your particular business. The Chart of Accounts is fluid and should help your better manage your business, rather than your business running you.

There are many different ways to tackle the world of software accounting as well as many ways to set up your chart of accounts. Focus on the key items that work for your business and ensure you are tracking all your important margins like the different types of revenue, cost of goods sold, research and development, along with employee wages.

Download the above sample Chart of Accounts by clicking here.

Leave a Reply